Legal issues should not be ignored by startups or founders of businesses as these can make or break their business. This course will guide you through basic legal requirements for doing businesses in Thailand so startups and founders will know about pitfalls to avoid and will be able to mitigate legal risks in advance.

📝 Course Outline

Doing business in Thailand as freelancers or companies

Legal requirements for freelancers VS Legal requirements for companies

- Doing business as an individual – liabilities under Thai laws

- Procedure to incorporate a limited company in Thailand

- BOI privilege for software business

Minimum corporate governance for Thai limited company

- Duties under the Civil and Commercial Code

- Duties under the Revenue Code

- Duties under other laws

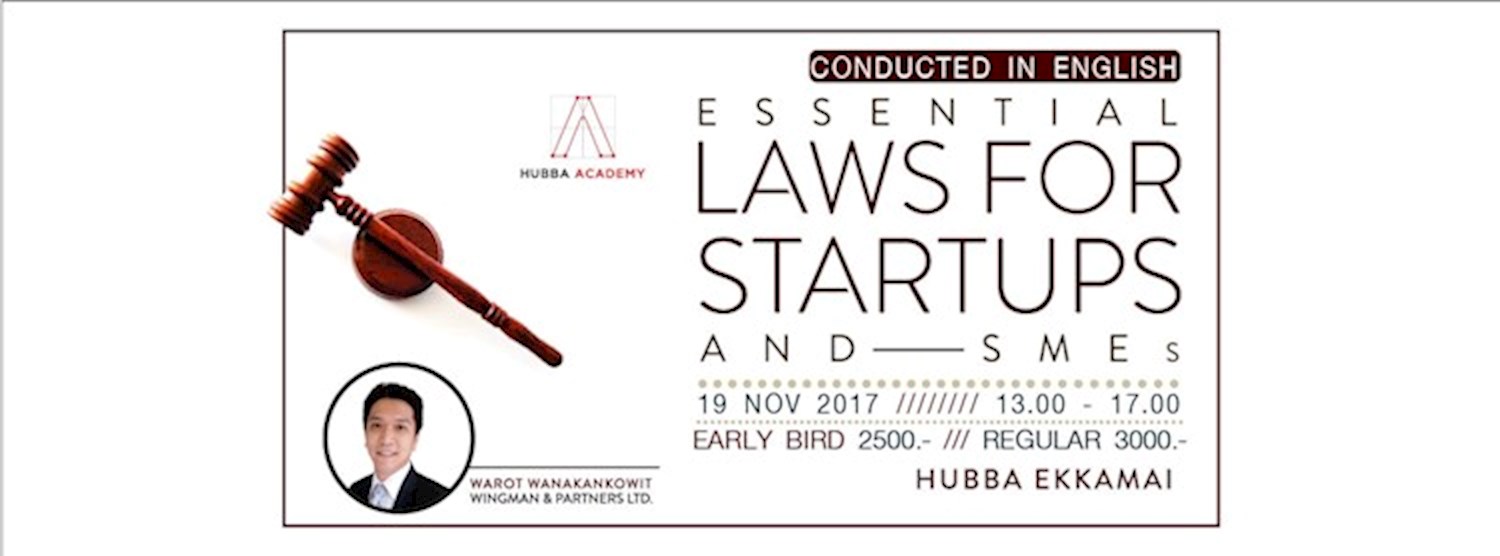

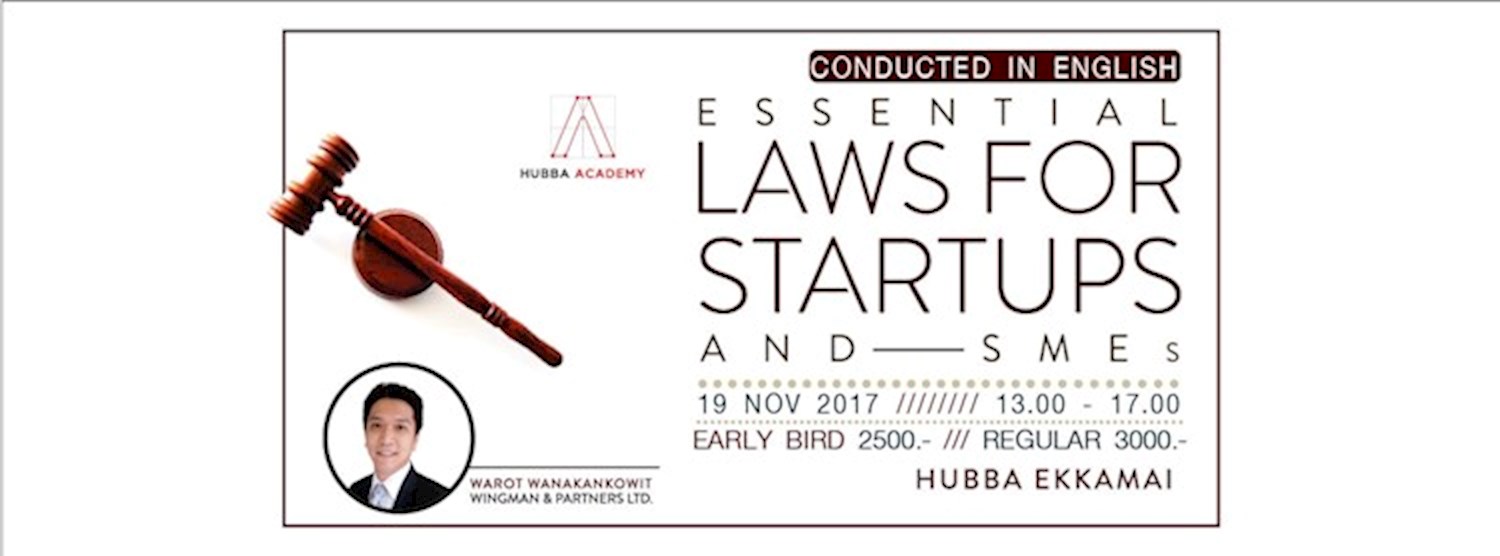

📅 Coure Details

Date: Saturday 19th November, 2017

Time: 13.00 - 17.00

Location: HUBBA Ekkamai 4

👨💼 About Instructor

Warot Wanakankowit

Partner of Wingman & Partners Ltd. and Warot Business Consultant Ltd.

Warot Wanakankowit is a partner of Wingman & Partners Ltd. and Warot Business Consultant Ltd. He has substantial experience with taxation, corporate and commercial, foreign business law, labour and employment and merger and acquisition transactions.

Prior to founding his own firm, Warot worked at Weerawong, Chinnavat & Peangpanor Ltd., one of leading law firms in Thailand. Before that he worked at KPMG Phoomchai Tax Ltd. as well as with PricewaterhouseCoopers Legal and Tax Consultants Ltd. in Thailand. Warot obtained an LL.B. degree from Thammasat University, and an LL.M. degree from King’s College University, in the UK.

Remark: HUBBA Academy reserve right for Non refoundable on any situation

19 Soi Ekkamai 4, Sukumvit 63 Rd., Prakanong Nua Bangkok, 10110 Thailand

VIEW MAP